Yes! You can use AI to fill out Form 4868, Application for Automatic Extension of Time To File U.S. Individual Income Tax Return

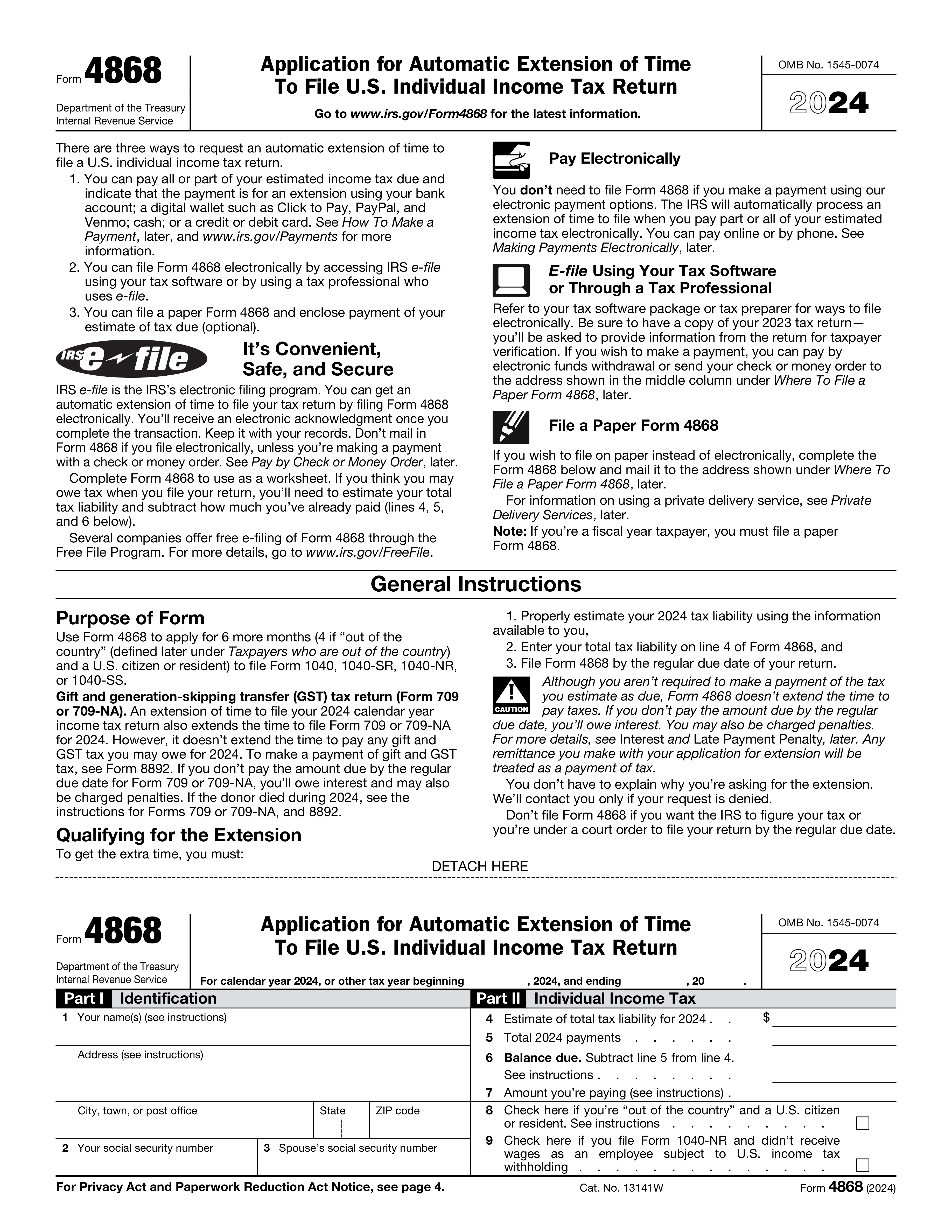

Form 4868, officially known as the Application for Automatic Extension of Time To File U.S. Individual Income Tax Return, is a document used by taxpayers to request additional time to file their tax returns. It grants an automatic 6-month extension, but it's important to note that it does not extend the time to pay any taxes owed. Filing this form is crucial for individuals who need more time to gather necessary documentation or for those who anticipate delays in filing their tax returns.

Our AI automatically handles information lookup, data retrieval, formatting, and form filling.

It takes less than a minute to fill out Form 4868 using our AI form filling.

Securely upload your data. Information is encrypted in transit and deleted immediately after the form is filled out.

Form specifications

| Form name: | Form 4868, Application for Automatic Extension of Time To File U.S. Individual Income Tax Return |

| Form issued by: | Internal Revenue Service |

| Number of fields: | 17 |

| Number of pages: | 4 |

| Version: | 2024 |

| Official download URL: | https://www.irs.gov/pub/irs-pdf/f4868.pdf |

| Language: | English |

Instafill Demo: filling out a legal form in seconds

How to Fill Out Form 4868 Online for Free in 2025

Are you looking to fill out a FORM-4868 form online quickly and accurately? Instafill.ai offers the #1 AI-powered PDF filling software of 2025, allowing you to complete your FORM-4868 form in just 37 seconds or less.

Follow these steps to fill out your FORM-4868 form online using Instafill.ai:

- 1 Visit instafill.ai and select Form 4868.

- 2 Enter your personal and tax information.

- 3 Estimate your total tax liability and payments.

- 4 Indicate if you're out of the country.

- 5 Sign and date the form electronically.

- 6 Check for accuracy and submit the form.

Our AI-powered system ensures each field is filled out correctly, reducing errors and saving you time.

Why Choose Instafill.ai for Your Fillable Form 4868 Form?

Speed

Complete your Form 4868 in as little as 37 seconds.

Up-to-Date

Always use the latest 2025 Form 4868 form version.

Cost-effective

No need to hire expensive lawyers.

Accuracy

Our AI performs 10 compliance checks to ensure your form is error-free.

Security

Your personal information is protected with bank-level encryption.

Frequently Asked Questions About Form Form 4868

Form 4868, Application for Automatic Extension of Time To File U.S. Individual Income Tax Return, is used by taxpayers who need more time to file their federal income tax returns. Filing this form grants an automatic 6-month extension, moving the filing deadline from April 15 to October 15. However, it's important to note that this extension applies only to the filing of the tax return, not to the payment of taxes owed.

To request an automatic extension of time to file your U.S. individual income tax return, you must file Form 4868 with the IRS by the original due date of your tax return, typically April 15. You can file Form 4868 electronically through IRS e-file using tax software or a tax professional, or you can mail a paper form to the IRS. Additionally, making a payment with the IRS's Direct Pay system, the Electronic Federal Tax Payment System (EFTPS), or by credit or debit card also serves as a request for an extension.

There are several methods available for making a payment to request an extension using Form 4868: 1) IRS Direct Pay, which allows you to pay directly from your bank account; 2) The Electronic Federal Tax Payment System (EFTPS), which is a free service provided by the U.S. Department of the Treasury; 3) Credit or debit card payments through an IRS-approved payment processor; and 4) Mailing a check or money order with a paper Form 4868. It's important to ensure that your payment is made by the tax filing deadline to avoid penalties and interest.

No, it is not necessary to file Form 4868 if you make an electronic payment for your estimated tax due. When you make an electronic payment and indicate that the payment is for an extension, the IRS automatically applies it as a request for an extension. You should keep a record of your payment confirmation as proof of your extension request. However, if you prefer to file Form 4868 for your records or to ensure clarity, you may still do so.

The deadline for filing Form 4868 is the same as the original due date of your tax return, which is typically April 15. If April 15 falls on a weekend or a holiday, the deadline is extended to the next business day. Filing Form 4868 by this date grants you an automatic 6-month extension to file your tax return, moving the deadline to October 15. Remember, this extension is for filing your return, not for paying any taxes you owe, which are still due by the original April 15 deadline to avoid penalties and interest.

Yes, you can file Form 4868 electronically. The IRS offers several options for electronic filing, including through IRS Free File, which is available on the IRS website, or through a tax professional who uses e-file. Additionally, you can use tax software that supports electronic filing of Form 4868. When filing electronically, you will need to provide the same information as you would on a paper form, including your personal information, an estimate of your total tax liability, and the amount you are paying, if any.

If you are out of the country and need an extension to file your U.S. individual income tax return, you can still file Form 4868. The IRS allows U.S. citizens and resident aliens who are out of the country on the regular due date of their tax return to have an automatic 2-month extension to file their return and pay any amount due without requesting an extension. For an additional extension beyond the 2-month period, you must file Form 4868 by the extended due date. Be sure to indicate on the form that you are out of the country.

If you do not pay the estimated tax due by the regular due date, you may be subject to penalties and interest on the unpaid amount. The IRS charges a failure-to-pay penalty, which is typically 0.5% of the unpaid taxes for each month or part of a month that the tax remains unpaid, up to a maximum of 25%. Additionally, interest is charged on the unpaid tax from the due date of the return until the date of payment. It's important to pay as much as you can by the due date to minimize these charges.

To estimate your total tax liability for Form 4868, you should review your previous year's tax return and consider any changes in your income, deductions, and credits for the current year. You can use the IRS Tax Withholding Estimator or consult tax preparation software to help calculate your estimated tax liability. It's important to make as accurate an estimate as possible to avoid underpayment penalties. If you're unsure, it may be helpful to consult with a tax professional.

The extension to file, granted by filing Form 4868, gives you additional time to submit your completed tax return to the IRS. However, it does not extend the time to pay any taxes owed. Taxes are still due by the original due date of the return. If you expect to owe tax, you should estimate and pay as much as you can by the due date to avoid penalties and interest. The extension to file does not extend the time to pay; it only extends the time to file your return.

Yes, you can still get an extension by filing Form 4868 even if you cannot pay the full amount of estimated tax due. However, it's important to pay as much as you can to minimize penalties and interest. The extension is for filing your tax return, not for paying your taxes. You may still owe penalties and interest on any unpaid tax after the original due date.

The penalties for late payment and late filing include a failure-to-pay penalty and a failure-to-file penalty. The failure-to-pay penalty is typically 0.5% of your unpaid taxes for each month or part of a month after the due date, up to 25%. The failure-to-file penalty is usually 5% of your unpaid taxes for each month or part of a month that a return is late, up to 25%. If both penalties apply in the same month, the maximum penalty for that month is 5%. Additionally, interest is charged on taxes not paid by the due date, even if an extension to file is granted.

Payments made with Form 4868 should be reported on your tax return when you file it. Include these payments in the total payments section of your tax return (Form 1040, 1040-SR, or 1040-NR). This ensures that the IRS applies your payment to your tax liability. Be sure to keep records of your payment for your own records and in case of any discrepancies.

If you change your name or address after filing Form 4868, you should notify the IRS as soon as possible. You can do this by filing Form 8822, Change of Address, or by sending a written statement to the IRS office where you filed your last return. Include your full name, old and new addresses (or old and new names), Social Security Number (SSN), and signature. This ensures that the IRS can contact you and send any correspondence to the correct address.

Form 1040-NR filers using Form 4868 should follow the same general instructions as other filers. However, nonresident aliens should ensure they understand their tax obligations and any treaties that may affect their tax situation. It's important to accurately estimate any tax due and make a payment with Form 4868 to avoid penalties and interest. Nonresident aliens should also be aware of any additional documentation that may be required when they file their final tax return.

The IRS accepts Form 4868 sent through certain private delivery services designated by the IRS. These services include, but are not limited to, DHL Express, FedEx, and UPS. It's important to use the correct IRS address for private delivery services, which may differ from the address used for USPS mail. Check the IRS website or the instructions for Form 4868 for the most current list of approved services and the correct addresses.

To make a payment using a check or money order with Form 4868, make your payment payable to the 'United States Treasury.' Ensure your payment includes your name, address, Social Security number, daytime phone number, and the tax year for which the payment is being made. Attach the payment to Form 4868 and mail it to the appropriate IRS address provided in the form's instructions.

There is no specified maximum amount you can pay with a single check when using Form 4868. However, ensure that the check is for the exact amount you wish to pay towards your estimated tax liability. If your payment is large, consider using electronic payment methods for convenience and security.

Form 4868 grants an automatic 6-month extension to file your U.S. Individual Income Tax Return. If you need more than 6 months, you must file another extension request or file your tax return by the extended deadline. Note that additional extensions beyond the initial 6 months are not automatically granted and require a valid reason, such as being out of the country.

To claim credit for a payment made with Form 4868, include the amount of the payment on the appropriate line of your tax return when you file it. This payment is considered an estimated tax payment and will be applied to your total tax liability. Ensure you report the payment accurately to avoid discrepancies that could lead to IRS notices or adjustments to your tax account.

Compliance Form 4868

Validation Checks by Instafill.ai

1

Ensures that the form is being filed for the correct tax year, specifically 2024, as indicated by the instructions.

The AI software ensures that the form is being filed for the correct tax year, specifically 2024, as indicated by the instructions. It verifies that the tax year mentioned on the form aligns with the current filing requirements. This check is crucial to prevent the submission of the form for an incorrect tax year, which could lead to processing delays or rejections. Additionally, it confirms that all references to the tax year within the form are consistent and accurate.

2

Verifies that the taxpayer's name and address are accurately entered in Part I—Identification, including both spouses' names and social security numbers if filing jointly.

The AI software verifies that the taxpayer's name and address are accurately entered in Part I—Identification. It ensures that the information matches the records held by the IRS, including both spouses' names and social security numbers if filing jointly. This validation is essential for the correct identification of the taxpayer(s) and to facilitate efficient processing of the extension request. It also checks for any discrepancies that might indicate potential errors or fraud.

3

Confirms that any changes in name or address have been properly notified to the Social Security Administration or updated using Form 8822, as required.

The AI software confirms that any changes in name or address have been properly notified to the Social Security Administration or updated using Form 8822, as required. It checks the consistency of the taxpayer's information with the latest records available to the IRS. This step is vital to ensure that all communications and refunds are sent to the correct address. It also helps in maintaining the accuracy of the taxpayer's records for future filings.

4

Checks that the total tax liability for 2024 is accurately estimated and entered on line 4 of Part II—Individual Income Tax.

The AI software checks that the total tax liability for 2024 is accurately estimated and entered on line 4 of Part II—Individual Income Tax. It ensures that the estimation is based on the taxpayer's income, deductions, and credits as per the latest tax laws. This validation is crucial for determining the correct amount of tax owed and for calculating any potential penalties or interest. It also helps in ensuring that the taxpayer is not underestimating their tax liability, which could lead to issues with the IRS.

5

Validates that total payments for 2024 are correctly entered on line 5 and that the balance due on line 6 is accurately calculated by subtracting line 5 from line 4.

The AI software validates that total payments for 2024 are correctly entered on line 5 and that the balance due on line 6 is accurately calculated by subtracting line 5 from line 4. It ensures that all payments made towards the 2024 tax liability, including estimated tax payments and withholding, are accurately recorded. This check is important for determining the correct balance due or refund amount. It also helps in identifying any discrepancies that might affect the taxpayer's financial obligations to the IRS.

6

Ensures that any payment made with the form is correctly entered on line 7 and that the appropriate boxes on lines 8 and 9 are checked if applicable.

The validation process ensures that any payment associated with Form 4868 is accurately recorded on line 7. It also verifies that the relevant boxes on lines 8 and 9 are marked correctly, if they apply to the taxpayer's situation. This step is crucial for accurately processing the extension request and any accompanying payment. It helps in avoiding delays or rejections due to incorrect or incomplete payment information.

7

Confirms that payments, if made, are correctly indicated as for an extension and that checks or money orders are made payable to 'United States Treasury' with the required details included.

This check confirms that any payments made with Form 4868 are properly designated as being for an extension of time to file. It ensures that checks or money orders are correctly made payable to 'United States Treasury' and include all necessary details, such as the taxpayer's identification information. This validation is essential for the proper allocation of payments to the taxpayer's account. It also aids in preventing misapplication of payments, which could lead to processing delays.

8

Verifies that the form is filed through the correct method (electronically or paper) and that electronic filers receive an acknowledgment.

The validation process verifies that Form 4868 is submitted using the correct filing method, whether electronically or via paper, based on the taxpayer's choice and eligibility. For electronic filers, it ensures that an acknowledgment of receipt is provided, confirming that the form has been successfully submitted. This step is important for maintaining a record of the submission and for providing peace of mind to the taxpayer. It also helps in identifying any issues with the submission process promptly.

9

Checks that paper forms are mailed to the appropriate address based on the taxpayer's location and whether a payment is being made.

This validation ensures that paper versions of Form 4868 are sent to the correct mailing address, which varies depending on the taxpayer's location and whether a payment is included. It is crucial for the timely processing of the form and any accompanying payment. This step helps in avoiding misdirection of the form, which could result in processing delays. It also ensures that taxpayers follow the correct procedures based on their specific circumstances.

10

Ensures that a copy of the completed Form 4868 and any payment confirmation are kept for the taxpayer's records.

The validation process ensures that taxpayers retain a copy of the completed Form 4868 and any confirmation of payment for their records. This is important for future reference and in case of any disputes or questions from the IRS. Keeping these documents helps taxpayers verify their filing and payment details if needed. It also serves as proof of compliance with the extension request process.

11

Confirms that the taxpayer understands that an extension to file is not an extension to pay and that interest and penalties may apply for unpaid amounts by the due date.

Ensures that the taxpayer is fully aware that applying for an extension to file their U.S. Individual Income Tax Return does not grant an extension for any taxes owed. It verifies that the taxpayer understands that interest and penalties may be applied to any unpaid amounts by the original due date of the return. This check is crucial for preventing misunderstandings about the nature of the extension. It also confirms that the taxpayer acknowledges the potential financial implications of not paying taxes by the due date.

12

Validates that the taxpayer has not stapled or attached their payment to Form 4868, as instructed.

Confirms that the taxpayer has followed the specific instruction not to staple or attach their payment directly to Form 4868. This validation ensures that payments are processed correctly and efficiently by the IRS. It checks for compliance with the form's submission guidelines to avoid processing delays. This step is essential for maintaining the integrity of the payment and form submission process.

13

Checks that the taxpayer has indicated their filing status correctly, especially if they are out of the country or file Form 1040-NR without U.S. income tax withholding.

Verifies the accuracy of the taxpayer's indicated filing status on Form 4868, with particular attention to those who are out of the country or filing Form 1040-NR without U.S. income tax withholding. This check ensures that the taxpayer's filing status aligns with their actual tax situation, which is critical for the correct processing of their extension request. It also confirms that the taxpayer has provided all necessary information relevant to their specific filing status. This validation is key to preventing errors that could affect the taxpayer's extension and subsequent tax filings.

14

Ensures that the daytime phone number is included with the payment if paying by check or money order.

Confirms that the taxpayer has included a daytime phone number with their payment when paying by check or money order. This validation ensures that the IRS can contact the taxpayer if there are any issues or questions regarding their payment. It checks for the presence of this crucial contact information to facilitate smooth communication. This step is important for resolving any potential payment-related inquiries efficiently.

15

Verifies that the taxpayer has visited www.irs.gov/Form4868 for any additional detailed instructions or updates.

Ensures that the taxpayer has accessed the official IRS website at www.irs.gov/Form4868 to review any additional detailed instructions or updates related to Form 4868. This validation confirms that the taxpayer is informed about the latest guidelines and requirements for filing an extension. It checks that the taxpayer has taken the necessary steps to stay updated on any changes that might affect their extension application. This step is crucial for ensuring compliance with current IRS procedures and avoiding potential filing errors.

Common Mistakes in Completing Form 4868

Filling out the name and address incorrectly or incompletely can lead to processing delays or the IRS being unable to contact you. Ensure that your name matches exactly what is on your Social Security card and that your address is current and complete. Double-check for typos or omissions before submitting. If you've recently moved, make sure to update your address with the IRS to avoid missing important correspondence.

When filing jointly, both spouses' names and Social Security Numbers (SSNs) must be included on Form 4868. Omitting this information can result in processing errors or delays. Verify that both names are spelled correctly and that the SSNs are accurate. This ensures that the extension applies to both individuals and that the IRS can properly process your request.

If you've changed your name or address, it's crucial to update this information with the Social Security Administration (SSA) or by filing Form 8822 with the IRS. Failure to do so can lead to mismatched records and potential issues with your tax return. Keeping your information current helps prevent delays in processing and ensures you receive any IRS communications. Always notify the IRS of any changes as soon as they occur.

Accurately estimating your total tax liability is essential for determining if you need to make a payment with Form 4868. Underestimating can result in penalties and interest. Use your previous year's tax return as a guide and consider any significant changes in income or deductions. If unsure, consult a tax professional to help make a more accurate estimate.

Miscalculating your total payments and the balance due can lead to underpayment penalties. Carefully review all payments made throughout the year, including withholdings and estimated tax payments. Ensure that all figures are accurately entered on Form 4868. If you're unsure about your calculations, seeking assistance from a tax advisor can help avoid costly mistakes.

A frequent oversight is failing to include the payment amount when submitting Form 4868 with a payment. This omission can delay the processing of your extension request. To avoid this, ensure that the payment amount is clearly indicated on the form. Double-check the form before submission to confirm that all required fields, including the payment amount, are accurately filled out. This step is crucial for the IRS to process your extension and payment correctly.

Applicants often neglect to check the boxes that apply to their special conditions, such as being out of the country or serving in a combat zone. This can lead to misunderstandings about your eligibility for an extension. Carefully review the form to identify any boxes that pertain to your situation and ensure they are marked. Taking the time to accurately complete this section can prevent unnecessary delays or complications with your extension request.

Errors in the payment method or details for electronic payments are common mistakes that can result in failed transactions. It's essential to verify that all payment information, including bank account numbers and routing numbers, are entered correctly. Additionally, ensure that the payment is directed to the correct IRS account for extension payments. Confirming these details before submission can help avoid payment processing issues.

Mailing a payment attached directly to Form 4868 is a mistake that can lead to processing delays. The IRS requires payments to be sent separately from the form to ensure proper handling. When mailing your payment, use the appropriate IRS payment voucher and send it to the designated address for payments. This separation helps the IRS process your payment and extension request more efficiently.

When making electronic payments, it's crucial to specify that the payment is for a tax extension. Failure to do so can result in the payment being applied to your tax liability instead of the extension. During the electronic payment process, select the option that indicates the payment is for an extension. This ensures that your payment is correctly allocated towards extending your filing deadline, not towards any outstanding tax balance.

A frequent misunderstanding is that an extension to file taxes also extends the deadline to pay any taxes owed. This is incorrect; taxes owed are still due by the original tax filing deadline. To avoid penalties and interest, ensure that any estimated taxes owed are paid by the original due date. Use the IRS's Direct Pay system or the Electronic Federal Tax Payment System (EFTPS) for timely payments. Keeping a record of the payment confirmation is also advisable for future reference.

When submitting a payment with Form 4868, it is crucial to make checks or money orders payable to the 'United States Treasury'. Failing to do so can result in processing delays or the payment not being credited to your account. Always double-check the payee information before sending your payment. Including your Social Security Number, daytime phone number, and '2024 Form 4868' on the payment can also help ensure it is applied correctly.

Omitting your Social Security Number, daytime phone number, or the notation '2024 Form 4868' on your payment can lead to processing delays. These details are essential for the IRS to accurately apply your payment to your tax account. Always include this information on the payment to avoid any issues. Additionally, consider using electronic payment methods that automatically include this information.

Mailing Form 4868 to the wrong address can delay the processing of your extension request. The correct mailing address depends on your state of residence and whether you are including a payment. Always verify the current mailing address on the IRS website or in the Form 4868 instructions before sending your form. Using certified mail or a delivery service that provides tracking can also help ensure your form is received.

Failing to keep a copy of your submitted Form 4868 and payment confirmation can create difficulties if there are any questions or issues with your extension request. Always make copies of all documents sent to the IRS, including the form and any payment confirmation. Storing these copies in a safe place will provide you with a reference in case you need to verify your submission or payment with the IRS.

A significant oversight when filing Form 4868 is not paying the estimated tax owed by the original due date of the tax return. This mistake can lead to penalties and interest on the unpaid amount, even if an extension is granted. To avoid this, taxpayers should calculate their estimated tax liability as accurately as possible and ensure payment is made by the regular due date. Utilizing the IRS's Electronic Federal Tax Payment System (EFTPS) can facilitate timely payments. Additionally, consulting with a tax professional can provide guidance on estimating taxes and making payments to prevent any potential penalties.

Saved over 80 hours a year

“I was never sure if my IRS forms like W-9 were filled correctly. Now, I can complete the forms accurately without any external help.”

Kevin Martin Green

Your data stays secure with advanced protection from Instafill and our subprocessors

Robust compliance program

Transparent business model

You’re not the product. You always know where your data is and what it is processed for.

ISO 27001, HIPAA, and GDPR

Our subprocesses adhere to multiple compliance standards, including but not limited to ISO 27001, HIPAA, and GDPR.

Security & privacy by design

We consider security and privacy from the initial design phase of any new service or functionality. It’s not an afterthought, it’s built-in, including support for two-factor authentication (2FA) to further protect your account.

Fill out Form 4868 with Instafill.ai

Worried about filling PDFs wrong? Instafill securely fills form-4868 forms, ensuring each field is accurate.